One downside to building a portfolio of condos and houses is that when it comes to selling, the process isn’t exactly quick. Plus, there are significant costs involved so if you need money quickly, tieing it up in property probably isn’t the right option.

This post by Jeff Anzalone explains how investing in real estate stocks is a really good alternative. You gain exposure to the property market which you’re able to quickly and cheaply turn into cash should you need to.

Plus, if you’ve got the appetite to do so, you can invest in property internationally via stocks listed in the country you want to great exposure to.

For full disclosure, real estate stocks are not something I invest in directly (although I do have a property portfolio) but I hold some expore to these stocks via my pension fund. Tim

It’s funny how sometimes life can give small clues as to how you should be handling your finances.

For example, a few years ago, a minor snow skiing accident revealed my lack of diversity regarding investing.

You’re probably scratching your head, wondering what I’m talking about. Let me set the scene for you.

After getting off a ski lift in Beaver Creek, Colorado, a kid darted from behind, causing me to swerve to avoid killing both him and me. I fell on my wrist, but luckily it wasn’t a major injury. As a periodontist, that wrist (and hand) are my livelihood.

The incident quickly made me realize that I was relying solely on one income; practice income.

Some questions that popped into my mind at that time were:

- What would I do for income if I would have broken my wrist?

- How would I provide for my family if I was permanently injured/disabled?

Too many folks I talk finance with are in the same boat I was a few years ago, relying on only ONE income stream. Not good.

At that time, our investments were mostly in Vanguard index funds locked away in retirement accounts. No other investment income or passive income was coming in, so something had to change.

I made it a point to find a solution and started by simply researching what wealthy people invested in.

Lo, and behold, I stumbled across a statistic that caught my attention:

Lo, and behold, I stumbled across a statistic that caught my attention:

Over 90% of millionaires have real estate in their portfolio

Back then, I didn’t hold any real estate investments and had no clue how it worked. The only real estate I was familiar with was the purchase of our home in 2005. That’s it.

So I decided to open my closed mind, read books, attend conferences, listen to podcasts, and network with real estate investors.

I was pleasantly surprised to learn that I didn’t have to acquire a second job and become a landlord. There were other options to get into real estate investing instead of becoming an active investor.

One of our main goals was to free up more time to spend with our kids before moving off to college, and dealing with tenants was not on our list.

Many of us are busy professionals and tend to focus on passive investments that don’t take up much of our time.

Within the passive investing strategy, two of the more popular investment opportunities are real estate syndications and real estate investment trusts, or REITs.

I’ve discussed real estate syndications in the past, so today, I want to highlight REITs, which are a collection of real estate stocks.

What Are Real Estate Stocks?

Real estate stocks can involve any publicly traded stock for a business that touches the real estate market in some shape, form, or fashion.

These can range anywhere from:

- real estate brokers

- technology companies

- manufacturers

- retailers

- developers

- financiers

Here are a few examples:

- Zillow

- Home Depot

- Re/Max Holdings

- CBRE Group

- Toll Brothers

Buying Real Estate Stocks

Investing in stocks is a straightforward process. This can be accomplished through any online brokerage account.

A major advantage of investing in real estate stocks is that you don’t have to have as much money to get started as you would directly buying the physical property.

This can help those who want to get started in real estate yet don’t have much to invest quite yet.

Like buying a property, finding the best opportunities, and investing in real estate stocks will require research and due diligence.

If you don’t understand an investment, then don’t put any money in until you do. As a stock’s definition is owning a small portion of a business, you should spend time learning about that business first.

You can educate yourself in several ways, such as reading books/blogs and listening to podcasts.

Here’s a handful of questions you should be able to answer to determine whether a stock is worth buying or not:

- How does the company make money?

- What makes it better or different than its competitors?

- How can it make more money?

- What risk could cause it to lose profits or fail in the future?

- Does the current stock price seem like a good buy?

What About REITS?

A REIT, or real estate investment trust, is a company that owns, operates, or finances income-producing real estate. They can either be private or public, with the publicly traded REIT being the more popular of the two.

An example of a REIT is one that buys and manages property such as:

- hotels

- self-storage

- retail centers

- healthcare facilities

- office buildings

- apartments

As a means of including the average investor into the real estate market, Congress established real estate investment trusts (REITs) as an amendment to the Cigar Excise Tax Extension of 1960.

The bill’s sponsors wanted to duplicate the success of the mutual fund industry by making it easier to attract capital to the real estate industry. They accomplished this by using a mutual fund’s equity structure to design a fund for real estate.

This allowed those who had a smaller amount of capital to invest in diversifying and benefiting from the real estate market.

The provision allows individual investors to buy shares in commercial real estate portfolios that receive income from various properties.

Investors can buy these shares by purchasing individual company stock, mutual funds, or exchange-traded funds (ETF).

This makes for a relatively simple way for investors to add real estate assets to their portfolios.

In exchange for receiving favorable tax treatment (they can avoid corporate taxation), REITs must distribute 90% of their profits in the form of dividends. The dividend revenue comes from rental income and capital gains.

Most REITs distribute these profits to their investors quarterly, making them a convenient interest-earning vehicle for those who want a steady stream of income.

REIT Example

Here’s an example of a popular REIT, the Vanguard Real Estate Index Fund (VGSLX).

According to the Vanguard site:This fund invests in real estate investment trusts—companies that purchase office buildings, hotels, and other real estate property. REITs have often performed differently than stocks and bonds, so that this fund may offer some diversification to a portfolio already made up of stocks and bonds. The fund may distribute dividend income higher than other funds, but it is not without risk.

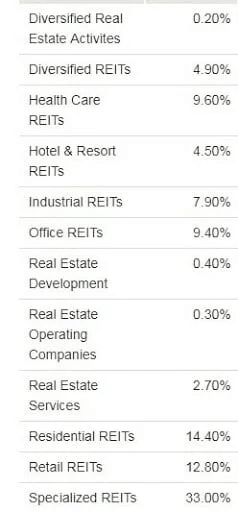

Here’s a breakdown of the Portfolio Composition:

As you can see below, it invests in a wide variety of different types of REITs, which as of this writing, includes assets over $64 Billion.

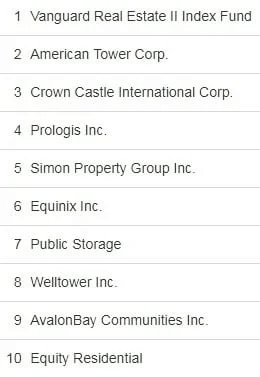

The 10 Largest Holdings are:

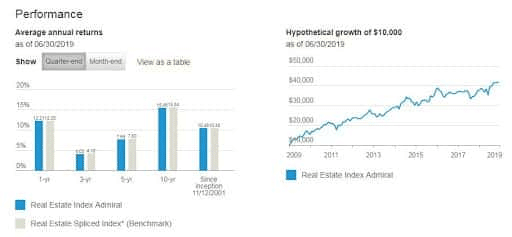

Its performance has been very impressive with earnings just over 10% since inception in 2001:

Advantages of Buying Stock in a REIT

- As previously mentioned, REITs must payout at least 90% of their income as dividends. As you can imagine, this is the main reason why investors put their money in them.

- These large payouts will result in above-average yields, which is great for the dividend investor.

- As opposed to owning physical property, REITs are more liquid as you only need to sell your shares to cash out.

- Investing in REITs helps to diversify your portfolio. Several years ago, our investment portfolio was 98% in the stock market. I wanted to change and diversify some portion of it and did so with the Vanguard Real Estate Index fund. For the most part, a real estate presence can be good for diversifying a portfolio by offering a different asset class that can act as a counterweight to equities or bonds.

- Lower cash flow risk: REITs offer attractive risk-adjusted returns and stable cash flow as they are highly diversified with 1000’s of properties to choose from.

Disadvantages of Buying Stock in a REIT

- Unfortunately for those investing in REITs for income, there larger tax consequences. The federal government taxes dividends at a lower rate than ordinary income, but that dividend tax benefit doesn’t apply to REIT holdings.

- Stock share prices can drop when property values fall.

- Tax inefficient: When comparing REITs to rental properties, actively managed real estate is more tax efficient. Starting in the first year, they can take depreciation, which can lower their “income” with a non-cash expense.

- Revenues are lowered with falling occupancy rates.

- Rising interest rates hurt profitability.

Are Real Estate Stocks Right For You?

Do you have financial goals? If so, have you considered how to lower your risk in case of an injury or permanent disability? What about risk mitigation?

One of the best ways to hedge against these negative situations is having diversity in your portfolio.

For many other high-income earners and us, real estate helps add to our portfolio’s diversification.

Investing in real estate stocks allows busy professionals to reap the benefits of owning property without the hassles of being a landlord. It also allows a much lower amount of money to initially invest versus spending hundreds of thousands (or millions) buying a property.

Whether or not real estate stocks are right for you comes down to whether you have the right kind of temperament to handle the up and down swings from stocks and can identify good businesses in which to invest over the long haul.

More Articles From Wealthy Living

- Best High Dividend Stocks: The Ultimate Millenials Investment Guide

- Dividend Kings Stocks That You Should Add to Your Watchlist Right Now

- Everything You Should Know About Rick Ross’ Net Worth and Other Facts

- Discover Blippi’s Net Worth and Other Fun Facts

Disclosure: The author is not a licensed or registered investment adviser or broker/dealer. They are not providing you with individual investment advice. Please consult with a licensed investment professional before you invest your money.

This article originally appeared on Your Money Geek and was syndicated by Wealthy Living.

Featured Image Credit: Shutterstock