Newly released data from the Federal Trade Commission (FTC) shows that scams are a big problem in the U.S. According to the FTC, Americans lost a massive $10 billion to fraud last year, up more than 14% on 2022. Let’s take a look at their findings and see which states are the most scammed.

Advanced Scams

In 2024, scams are only getting trickier to catch out. Last year, the FTC got reports of fraud from 2.6 million people – about the same as in 2022. However, the methods scammers employed are quite different.

Investment Scams Surge

Last year saw people losing a lot of money to investment scams, with over $4.6 billion lost – a big jump from the previous year.

Imposter Scams

Top of the list of frauds were imposter scams. Imposter scams (where a scammer pretends to be someone else to trick you into giving them money or personal information) caused losses of nearly $2.7 billion.

Payment Pitfalls

Bank transfers and cryptocurrency caused more losses than any other payment method last year.

Online Shopping Scams

The second most reported frauds in 2023 were problems with online shopping, followed by scams related to prizes, investments, business opportunities, and jobs.

Communication Shift

In 2023, scammers mostly reached out to people through email, which was a change from previous years when text messages were more common. Phone calls and text messages were also common ways scammers contacted people last year.

Age Vulnerability

While a lot of people think that scams only affect the older generation, the FTC’s data shows that people aged between 30-39 had the highest amount of fraud reports per 100k population.

Scams Can Hit Anyone

Although those aged older had a higher average dollar loss, it goes to show that everyone is vulnerable to scammers.

Geographic Fraud Hotspots

Last year a report was published by Forbes into which states were the most scammed. They analyzed data from the FTC for the first quarter of 2023 and found that these were the worst-hit states.

California’s Fraud Epidemic

- California

California took the top spot with a score of 100 out of 100 in the fraud ranking. In the first quarter of 2023, it reported approximately 47,000 fraud incidents, leading to a total loss of $249 million. The median loss per victim stood at $700.

High Incidents, Significant Losses

- Florida

With a score of 99.6 out of 100, Florida ranked second. It reported around 29,600 fraud incidents, resulting in a loss of $99.9 million. The median fraud loss was $620 per incident.

Rising Fraud Concerns

- New Jersey

New Jersey ranked third with a score of 91.6 out of 100. It reported 11,230 fraud incidents, with a total loss of $44.8 million. The median loss per victim was $593.

Significant Fraud Reports and Losses

- Texas

Texas secured the fourth position with a score of 91.2 out of 100. It reported over 29,850 fraud incidents and a loss of $119.6 million, with a median loss of $540 per victim.

High Fraud Rates

- Georgia

Georgia ranked fifth with a score of 89.8 out of 100. It reported 13,930 fraud incidents and a total loss of $33.4 million. The median loss per incident was $600.

Rising Fraud Instances

- Arizona

Arizona ranked sixth, reporting 9,890 fraud incidents and a loss of $33.5 million, with a median loss of $650 per victim.

A Focus on Fraud Incidents

- Maryland

Maryland secured the seventh position with 9,240 fraud incidents and a loss of $34.7 million, with a median loss of $580 per incident.

New York’s Total Losses

- New York

New York ranked eighth, reporting 22,688 fraud incidents and a loss of $64.9 million, with a median loss of $500 per victim.

Illinois’ Fraud Reports

- Illinois

Illinois ranked ninth, reporting 14,530 fraud incidents and a loss of $42.3 million, with a median loss of $511 per incident.

Substantial Reports and Losses

- Pennsylvania

Pennsylvania secured the tenth position with 15,360 fraud incidents and a loss of $38.8 million, with a median loss of $500 per victim.

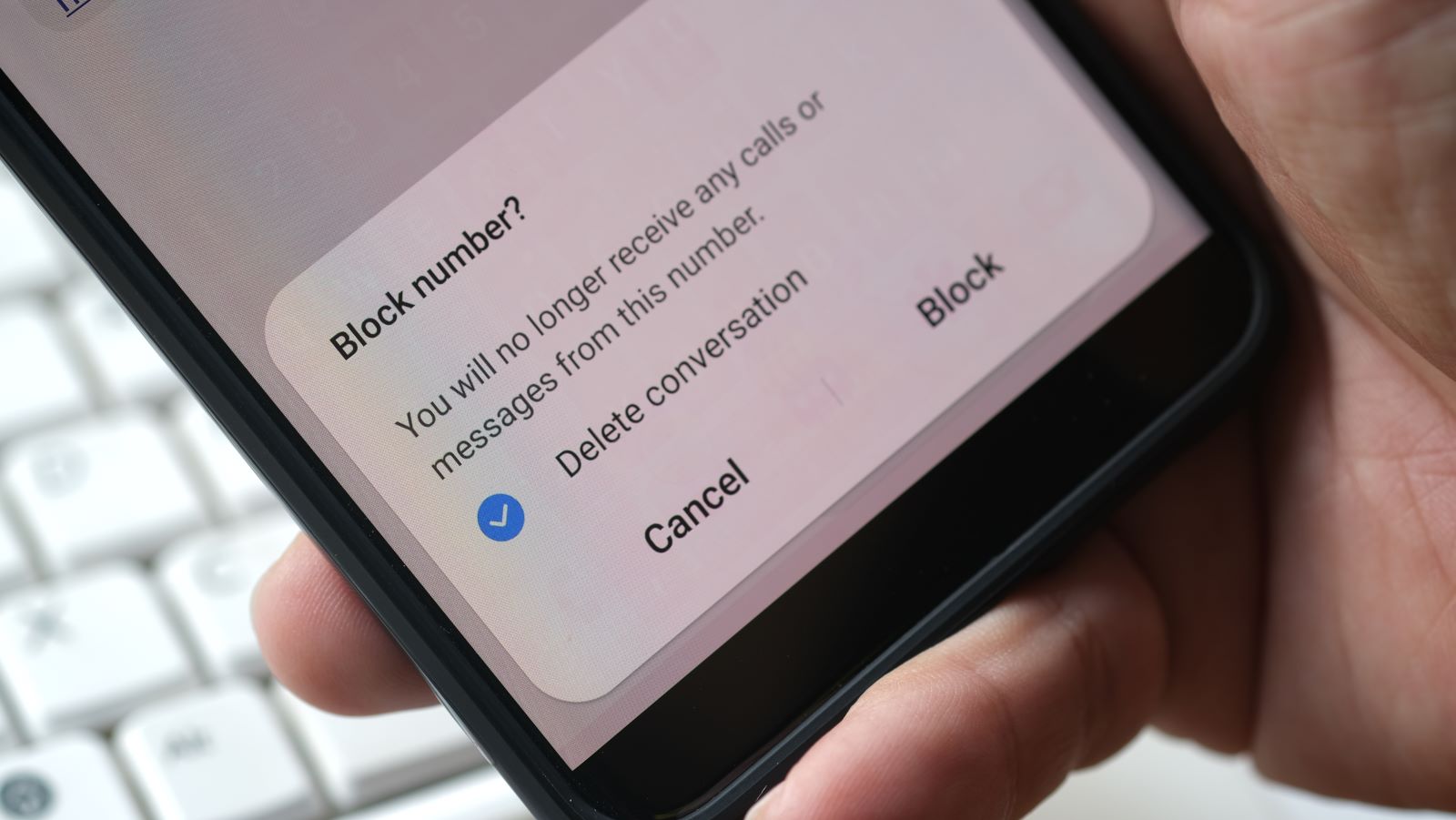

Scam Awareness

As scams become more and more sophisticated, it’s vital that people stay aware.

Personal Data Protection

Never give up personal details over the phone or email unless you’ve contacted the business or company through a verified channel. Don’t trust any contact details provided in any messages; they might be fake and lead to scams.

Vigilance Pays Off

Staying vigilant and informed about the latest scams is key to protecting yourself.

The post – Scams Strip $10 Billion from Americans Last Year – first appeared on Wealthy Living.

Featured Image Credit: Shutterstock / fizkes.

The content of this article is for informational purposes only and does not constitute or replace professional financial advice.