A new law backed by the Biden administration to permanently lower credit card fees has been temporarily struck down by a federal judge.

New Rule Blocked in Court

A Texas judge has moved to temporarily block a new law passed by the Biden administration that would place an $8 cap on credit card fees.

Getting Rid of “Junk Fees”

The new limit was proposed by the Consumer Financial Protection Bureau as part of the government’s ongoing plan to rule out predatory “junk fees” that drain billions from consumer pockets every year.

$8 Fee Cap Per Month

It would stop credit card companies and banks from enforcing exorbitant late fees for missed credit card payments, limiting them to $8 fees per month at the most.

Some Exceptions

If these companies could prove, via company data, that they needed to charge higher fees to recuperate annual losses, they may be exempted from the rule.

Only Applies to Large Issuers

If it is eventually enforced across the board the rule will only apply to large credit issuers, i.e. companies with more than 1 million open accounts.

Judge Pittman Rules It Out

But on Friday U.S. District Judge Mark T. Pittman, based in Fort Worth, moved to block the CFPB ruling, granting a preliminary injunction to the many businesses and banking institutions that had spoken out against the policy.

Lawsuit from the Chamber of Commerce

These businesses and institutions, backed by the US Chamber of Commerce, moved to sue the CFPB on the grounds that the new rule violated several federal statutes.

Circuit Court of Appeals

Pittman, who was appointed to the federal courts under former president Donald Trump, used a ruling by the New Orleans-based 5th U.S. Circuit Court of Appeals in 2022 to block the ruling.

“Likely Unconstitutional”

During that case the Circuit Court of Appeals deemed the CFPB’s funding structure to be “unconstitutional.” “Consequently, any regulations promulgated under that regime are likely unconstitutional as well,” Pittman ruled. “Thus, Plaintiffs establish a likelihood of success on the merits.”

Celebrating Their Victory

The 2022 ruling will then be considered by the US Supreme Court, but for now, detractors of the CFPB are rejoicing at their temporary victory under Pittman.

“A Win for Responsible Consumers”

Counsel to the U.S. Chamber of Commerce Litigation Center called the decision “a major win for responsible consumers who pay their credit card bills on time and businesses that want to provide affordable credit.”

A Year of Lobbying

The Chamber, as well as large credit card companies and big banks, spent an entire year lobbying hard against the CFPB while claiming late fees as an essential part of their business operations.

Major Banks Unite

This group included major corporations like Bank of America, JP Morgan Chase, Capital One, and CitiBank. The American Bankers Association and the Consumer Bankers Association also took part in the Chamber’s lawsuit.

CFPB Aren’t Happy

However, the CFPB and consumer advocacy groups have condemned the move and the bureau has vowed to continue pushing to lower credit card late fees.

Considerable Reductions

By reducing late fees to an $8 maximum, the rule would cut the current average late fee by 75%, from $32.

“Shouldering $800 Million in Late Fees Per Month”

“Consumers will shoulder $800 million in late fees every month that the rule is delayed — money that pads the profit margins of the largest credit card issuers,” a spokesperson told reporters.

Going on for “Far Too Long”

Chuck Bell, program director for the consumer advocacy group Consumer Reports called Pittman’s decision “disappointing,” adding that “Credit card companies have been bilking consumers out of billions of dollars in excessive late fees for far too long.”

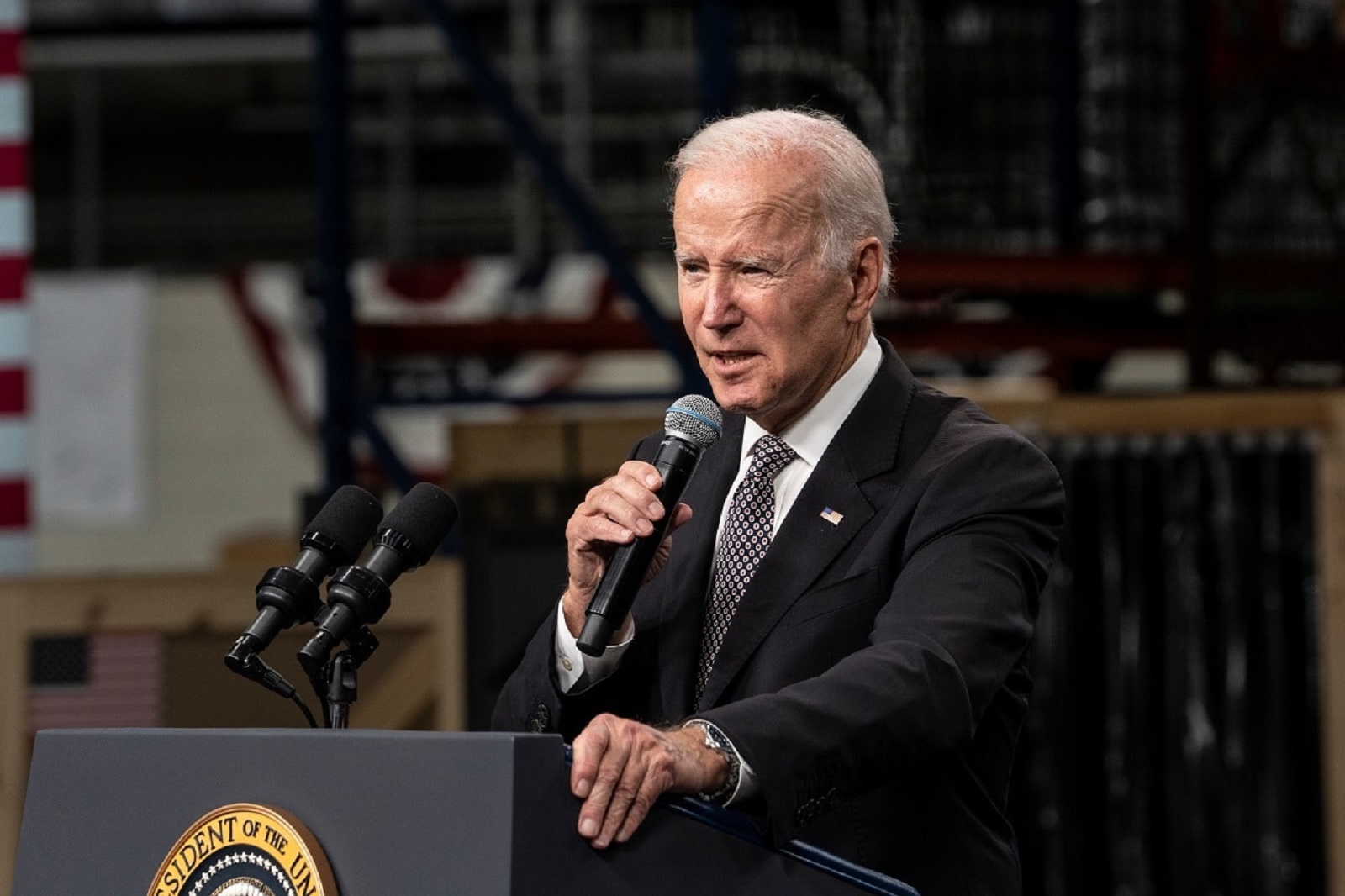

Backed by Biden

The White House has also expressed its disappointment, as the rule was fully backed by President Biden.

White House Disappointed

“We are disappointed that a court sided with House Republicans, big banks and special interests to hit pause on a critical measure to save American families billions in junk fees,” said White House spokesperson Jeremy Edwards.

Continuing to Cut Junk Fees

The Biden administration remains steadfast in reducing junk fees like late credit card fees, which will be a major boon for millions of American households. According to a recent Consumer Reports survey, one in five adults has paid a late fee on their credit cards in the last 12 months.

The post – Federal Judge Rejects Law on Credit Card Late Fees – first appeared on Wealthy Living.

Featured Image Credit: Shutterstock / kitzcorner.

The content of this article is for informational purposes only and does not constitute or replace professional financial advice