JPMorgan Chase Bank has courted controversy this week with a new feature and the launch of Chase Media Solutions, which critics are worried could spell big issues for your data privacy. Here’s the full report.

Inescapable Ads

Targeted ads are quite literally everywhere.

Data Harvesting

Whenever you search for something online, watch a video, or read an article, your data is collected and used to craft a series of personalized adverts for products the advertising algorithm thinks you might be interested in.

From Browsing to Buying

Watched a cooking video? Maybe you’ll want this new knife set! You’re googling holiday prices – here’s every hotel in Barbados. If you’re reading an article about fashion, expect to see a lot of clothing adverts.

Listening In

According to some, targeted ads don’t even require text.

Although this may seem conspiracy territory, some studies into whether phones are constantly listening in and using what they hear to curate targeted ads have seen some noteworthy results – most recently, a study by the Spanish education institution Esade.

Banking on Ads

Well, the next step to targeted ads comes from JPMorgan Chase, who has announced the creation of “Chase Media Solutions” – a unit responsible for curating targeted discounts and deals related to your account’s spending history.

Chase Media Solutions

Chase Media Solutions “serves as a key conduit for brands, connecting them with consumers’ personal passions and interests,” the company said in a press release.

The Chase Approach

Essentially, customers’ spending habits and data will be used to create a series of targeted offers and adverts for products and brands that marketers think they’ll be interested in.

Precision Marketing

The company explains in the press release, “With Chase’s owned transaction data, brands and agencies can precisely target customers at scale based on purchase history (such as targeting new, lapsed or loyal customers).”

Chase’s Advertising Reach

These ads will only appear on Chase’s banking app and website, which over 80 million Americans use regularly.

The Appeal of Targeted Ads

Chase’s advertising move follows in the footsteps of other businesses that have implemented similar marketing strategies on their websites and apps.

Cost-Effective Campaigns

It’s an attempt to cut down on wasted advertising costs, as targeted ad campaigns are a lot cheaper than huge ad rollouts that target everyone and typically result in fewer sales.

Pay for Performance

Unlike traditional advertising models, Chase’s approach only charges advertisers when a customer uses a deal to make a purchase.

Tracking Ad Effectiveness

This allows businesses to track the effectiveness of their advertising spending with Chase – a factor that has a lot of appeal for marketers looking to cut costs.

Cash Back Deals

To get these deals, customers just have to activate them on the Chase app or website. Instead of using discount codes, Chase will automatically apply cash back to customers’ cards after a qualifying purchase.

Chase’s Credit Card Monopoly

This all comes as part of Chase’s efforts to enhance its credit card division and maintain its position as the largest credit card issuer in the U.S.

Customer Benefits

Chase maintains that this is a positive improvement for customers, who will “benefit from personalized offers and the ability to earn cash back with brands they love or are discovering for the first time.”

The Customer Perspective

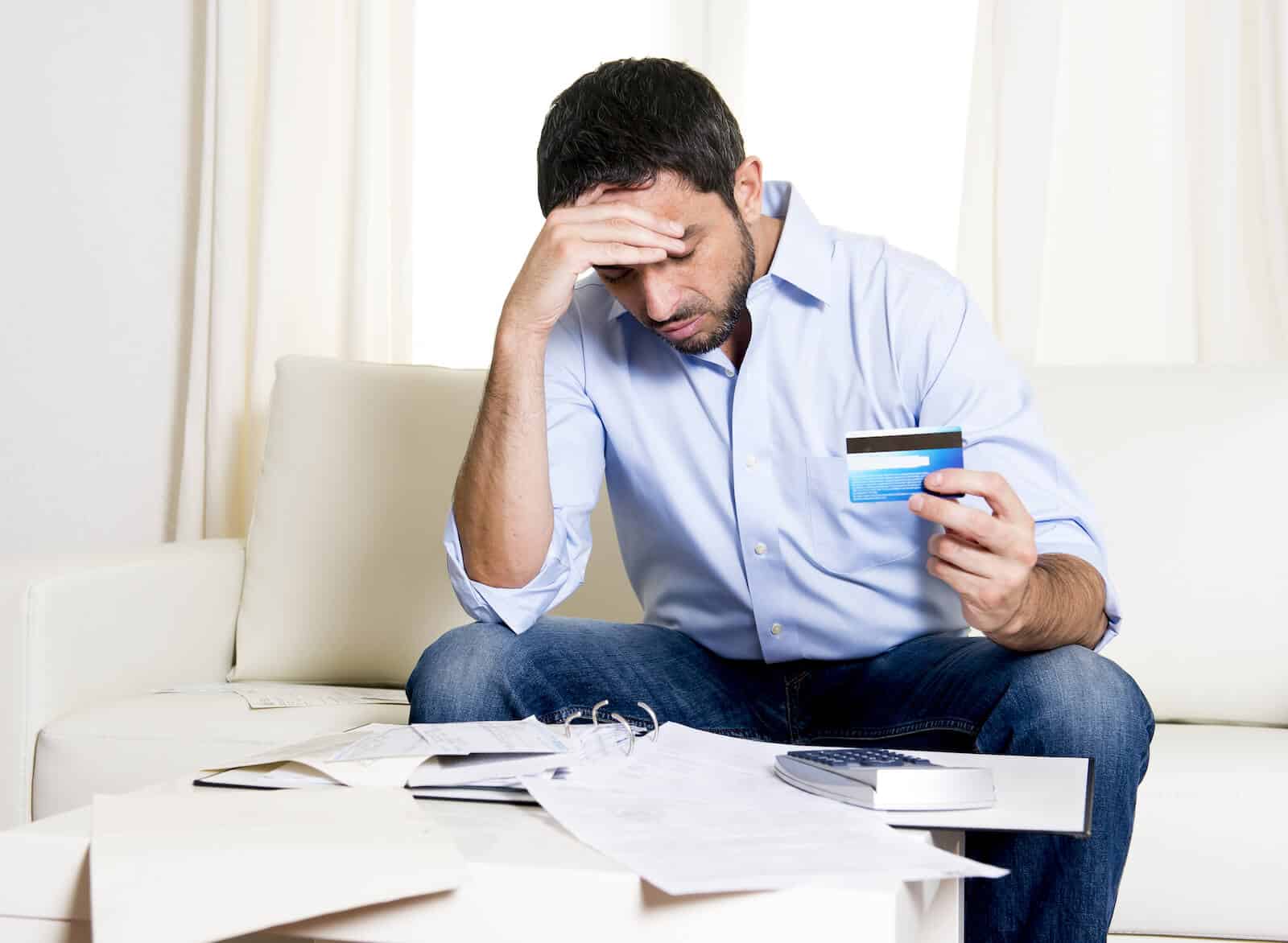

However, it’s caused a significant outcry from some users who are worried about their data privacy and dislike the idea of being marketed to advertisers as a product.

Personalized Offers vs. Privacy Concerns

It’s particularly worrying for some as their banking and spending data is a sensitive subject – the idea of the bank using their private data to tempt them into spending more money is not sitting well with many.

Chase’s Assurance on Privacy

JPMorgan Chase has stated “that the proprietary data that powers Chase Media Solutions’ campaigns remains within the bank’s highly secure environment. We do not share customers’ personally identifiable information or financial data with brands, merchants or anyone. Information about our customers is not shared as a matter of privacy, security and the fact that we’re a highly regulated company.”

Whether this will be enough to ease people’s concerns, however, remains to be seen.

Pilot Success

Chase has already rolled out pilot testing for the new ad campaigns with Air Canada, Solo Stove, Blue Bottle, and Whataburger. These companies apparently all saw “significant traction,” meaning increased revenue and customer growth.

The post JPMorgan Chase’s Data-Driven Ad Campaigns: Convenience or Privacy Invasion? first appeared on Wealthy Living.

Featured Image Credit: Shutterstock / JHVEPhoto.

The content of this article is for informational purposes only and does not constitute or replace professional financial advice.