Education Secretary Miguel Cardona has unveiled a significant new federal initiative in New York City designed to assist millions of Americans with their student loans. This ambitious plan represents a critical component of President Joe Biden’s commitment to fulfilling a major campaign promise.

Reworking How Student Loans Operate

The newly proposed federal student debt relief plan aims to rework how student loans function in the United States. Led by Education Secretary Miguel Cardona and supported by President Joe Biden, this effort strives to lessen the financial load millions of borrowers face.

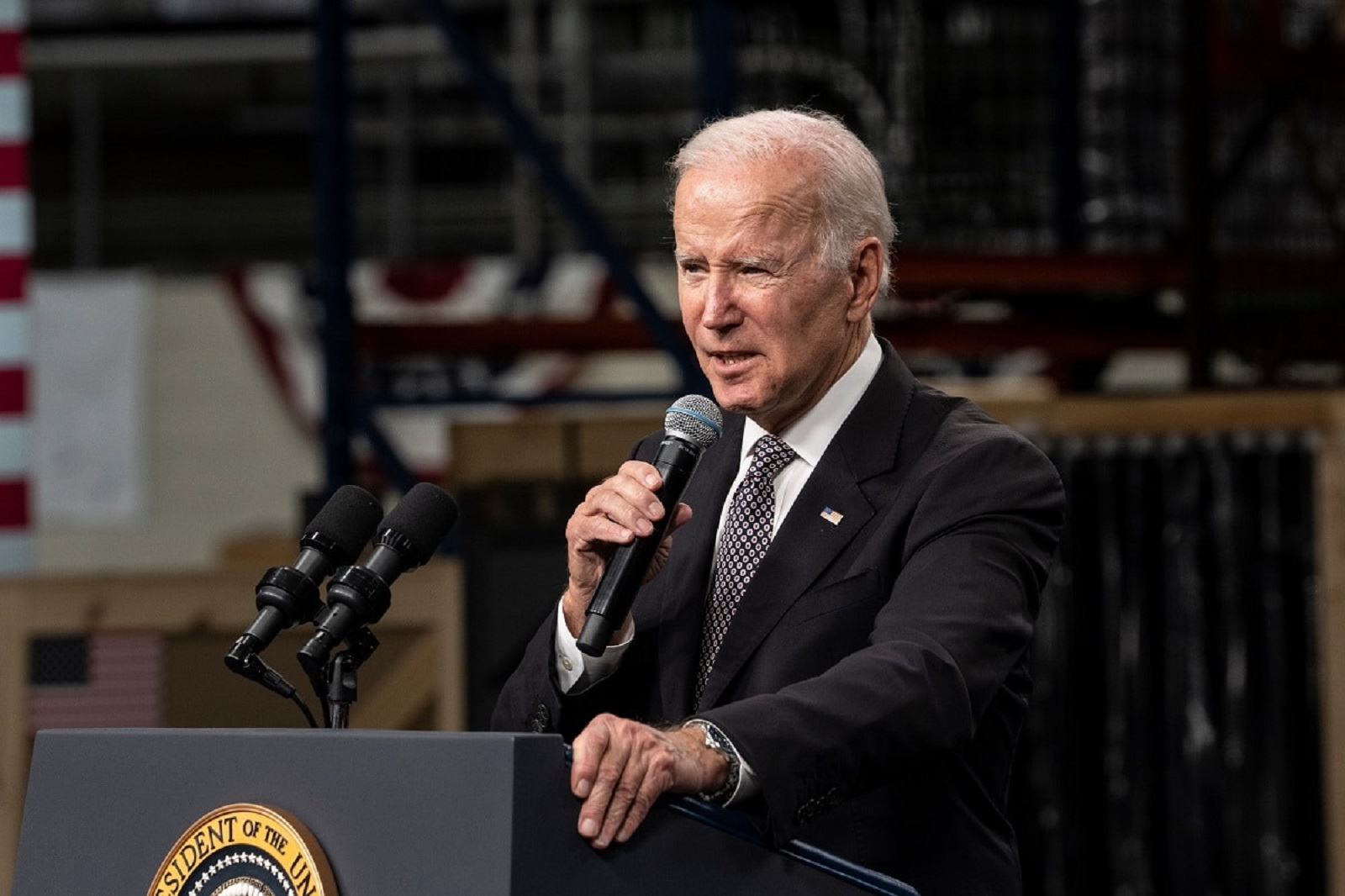

Learning from Previous Setbacks

After the Supreme Court denied President Biden’s first student debt relief plan, his team renewed efforts. By analyzing previous challenges, they devised a new approach that aligns with existing laws yet continues to deliver the necessary assistance.

Legal Rules

At the heart of the new proposal is the use of the Higher Education Act, which authorizes the Education Department to forgive student loans under certain conditions. Leveraging this law helps to overcome legal roadblocks while still following existing rules.

Focused Relief Actions

These relief measures are specifically targeted at particular groups of borrowers. By focusing their efforts, the administration can channel assistance where it is most needed, thereby ensuring the most beneficial impacts.

Addressing Neglected Needs

This plan aims to address the needs of borrowers hit hardest by the student debt crisis. With specialized relief steps, policymakers are seeking to reduce financial burdens for people and families nationwide.

Helping Borrowers in Need

A key feature of the proposed plan is to implement automatic relief operations and streamline processes for eligible borrowers, enhancing efficiency and accessibility.

A Burden Lifted

One of the suggested relief measures is to cancel interest for borrowers owing more than their original loan amounts. This crucial step alleviates the compounding interest burden, offering a fresh start for millions caught in the vice-like grip of student debt.

Fair Access for All

Policymakers are diligently working to ensure the equitable distribution of relief resources by establishing parameters that effectively address the diverse financial realities of borrowers.

Public Service Loan Forgiveness Program

The new plan also seeks to help borrowers who qualify for functioning federal forgiveness initiatives like the Public Service Loan Forgiveness program.

Long-Term Borrowers

Individuals who have held undergraduate loans for 20 years or more and those with graduate loans for 25 years or more are eligible for relief under this initiative. This measure aims to assist those who have been diligently making payments for many years.

Fixing Institutional Failures

The plan addresses the issue of “low financial value” educational programs that failed to fulfill their promises to students. It aims to assist those affected and compensate for the consequences of mismanagement or fraud by educational institutions.

Hardship Considerations

Acknowledging the varied challenges borrowers face, the plan also provides a mechanism for those with unique financial troubles to seek help. Policymakers have set up an application system designed to offer relief to individuals experiencing exceptional financial hardships.

Implementation Timeline

The relief measures are anticipated to begin this fall, though the exact timeline for implementation will hinge on regulatory approvals and procedural steps. As policymakers continue to refine the rules, recipients may see date changes for expected relief.

Legal Challenges

The administration believes the plan is in line with the law. However, conservative groups will likely challenge the plan in court and argue that it is non-compliant with existing regulations.

Political Dynamics

The future of the proposed relief plan is closely linked to the perspectives of political parties. Republicans generally oppose widespread student loan cancellation, positioning the plan at the center of significant legal and political challenges. Consequently, the outcome remains uncertain.

Potential Reversibility

If the plan faces legal issues or the political situation changes, the canceled loans may need to be reinstated. While possible, undoing loan forgiveness would be difficult logistically and politically; this shows how complex it is to provide student debt relief.

Public Discourse

The proposed relief plan has started a lot of public discussion. As policymakers consider different factors, public involvement remains important in shaping future debt relief efforts.

Financial Implications

The financial implications of the suggested relief plan have not yet been fully determined. However, its economic effects are expected to be extensive. Leaders must strike a balance between fiscal responsibility and humanitarian needs when allocating funds, leading to ongoing debates and rigorous scrutiny.

Societal Impact

Beyond immediate financial effects, the proposed aid has profound societal implications. By tackling education system inequalities, policymakers aim to build a society where money does not prevent education access.

Congressional Oversight

While the Biden administration asserts the legal basis for the proposed aid, congressional approval remains crucial. Bipartisan cooperation will determine the plan’s fate as lawmakers navigate legislative channels.

The post – What Biden’s Latest Student Loan Relief Means for You – first appeared on Wealthy Living.

Featured Image Credit: Shutterstock / Orlowski Designs LLC.

The content of this article is for informational purposes only and does not constitute or replace professional financial advice.